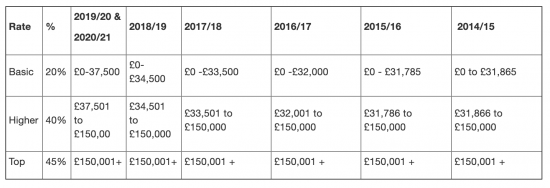

Beth Rigby on X: "NEW: As Johnson gives evidence, Sunak chooses to publish his tax return. 2019/20: cap gains £133,589 income tax £123,107 total: £227,350 2020/21: cap gains £285,382 income tax £124,473

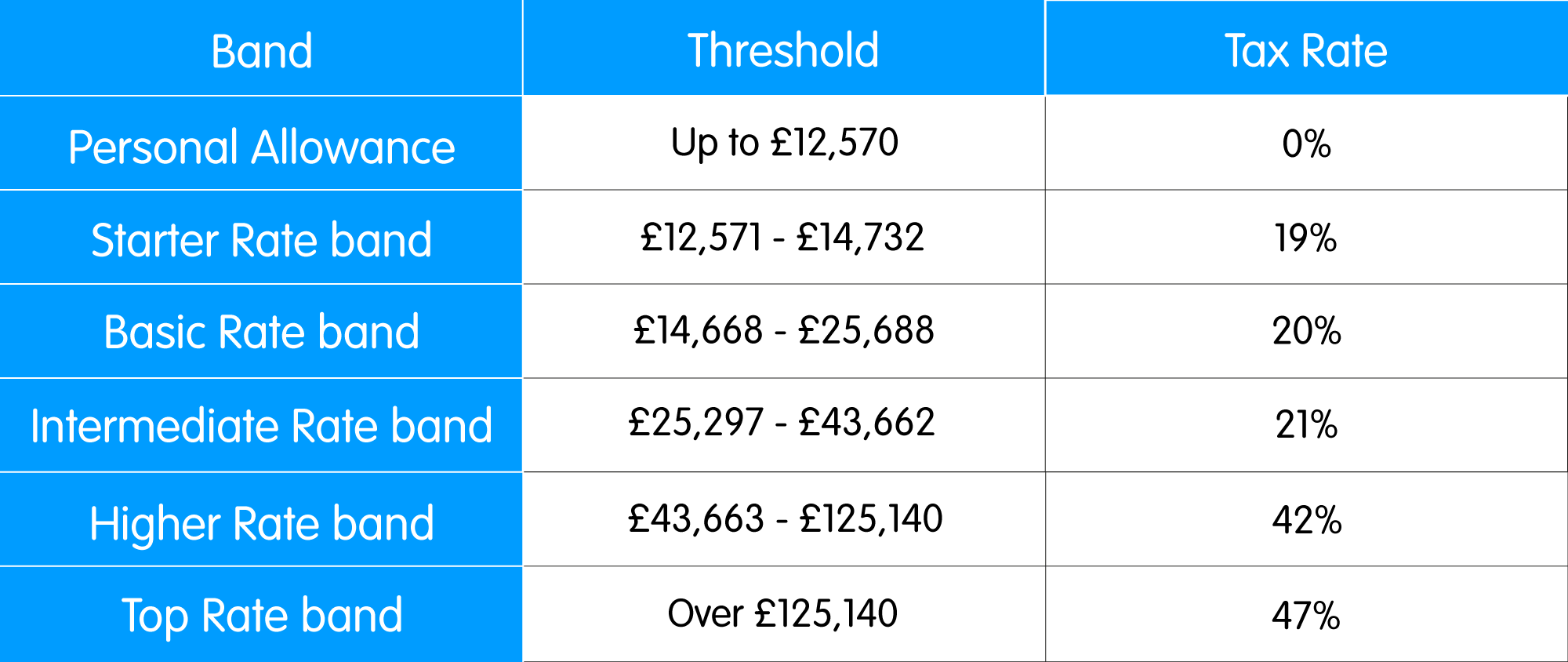

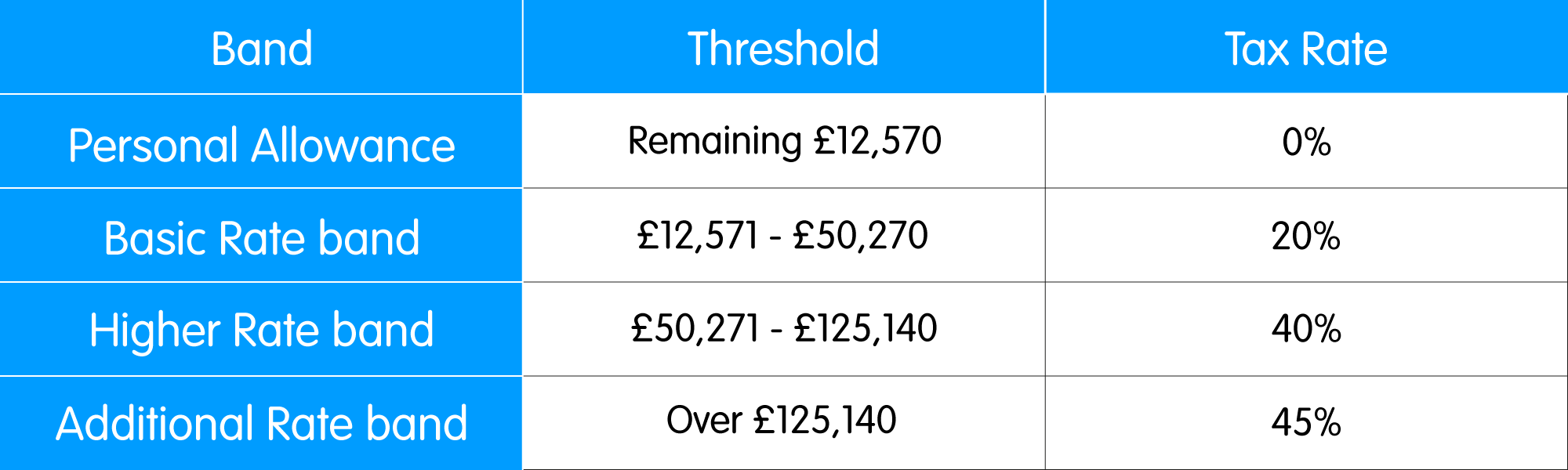

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2024/25 and 2023/24 | The Accountancy Partnership

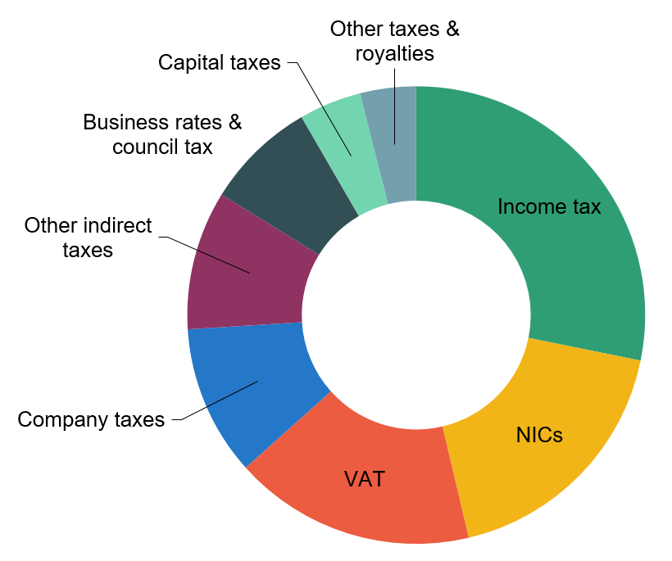

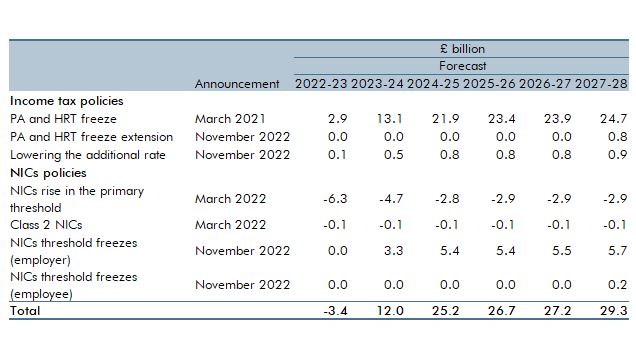

Arun Advani on X: "Latest @HMRCgovuk #capitalgains stats out. *Big* jump in number and amount of gains (c20%), and in tax paid (42%). Jump in gains bcos ppl worried abt CGT reform